Overview

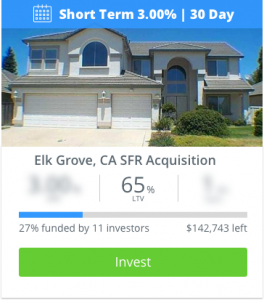

A 30-Day Note is a short-term investment that provides investors with more liquidity. Currently, we are rolling out this investment opportunity as a pilot program. The term of the note is 30 days of an existing loan, regardless of the actual term of the existing loan. Just like any other investment on our platform, loans selected for this program always meet PeerStreet’s standard underwriting guidelines.

30-Day Notes are an option for investors who want to allocate a portion of their portfolio to short-term investments. In a 30-Day Note, principal and interest will be repaid to the investor when the note matures at 30 days. After the note matures, the investor may choose to invest again in the same or another 30-Day Note.

The loan underlying the note issued by PeerStreet is secured by real estate collateral. PeerStreet will repay principal and interest at the end of the 30-day period. In addition, PeerStreet may apply a liquidity premium on each 30-Day Note offered for investment. This liquidity premium will always be disclosed to investors on the loan details page. To the extent that you’ve invested in 30-Day Notes in the past, you may have the opportunity to invest in additional 30-Day Notes prior to the investment window for all other investors on PeerStreet.

FAQs

What happens if payment is late or if there is prepayment? Regardless of whether loan payments on the underlying note are made by the borrower on a timely basis, PeerStreet will pay principal and interest in full to the investor at the end of the 30-day period.

What is the liquidity premium? The liquidity premium is the fee that PeerStreet earns for bearing the obligation of repaying principal and interest to the investor at the end of the 30-day period. Generally, this fee will be in the range of 3% to 8% and it will always be disclosed to investors on the loan details page.

When will I get paid? As with our standard investments, interest begins accruing after the investment closes. Interest and principal will be repaid to investors on the 30th day following the 30-Day Note closing. This is the Maturity Date listed in the Investment Overview of the loan.

Are 30-Day Notes included in Automated Investing? Yes, 30-Day Notes are included in Automated Investing.

Disclaimer: The information provided in this site, including, without limitation, the 30-Day Note image, should not be construed as advice on any subject matter whatsoever. You should not act or refrain from acting on the basis of any content included in this site without seeking legal or other professional advice. This information is provided strictly for informational purposes only and is subject to change from time to time without notice to you.