PeerStreet is closely following the impact COVID-19 is having on our communities, the markets, and the world. We are regularly reviewing policies and procedures in response to the current market.

Below is a frequently updated list of resources for investors:

CEO Response

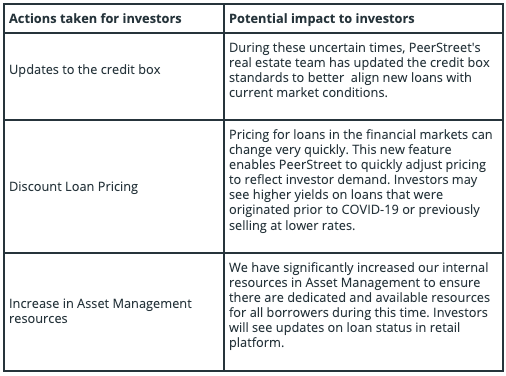

Actions implemented by PeerStreet

Discount Loan Program

FAQs

CEO Response

Our CEO’s analysis of the market and the potential impact it will have on real estate going forward can be viewed here.

Actions implemented by PeerStreet

PeerStreet is here to help investors, lenders, and borrowers through this difficult time.

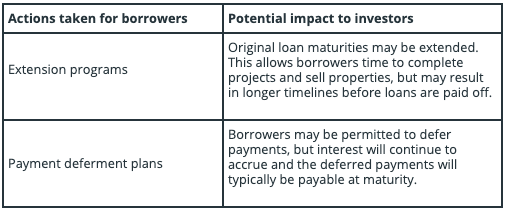

Discount Loans

Pricing for loans in the financial markets can change very quickly. The new feature that we have built enables PeerStreet to quickly adjust pricing to reflect market demand.

FAQ

How does the COVID-19 affect PeerStreet’s ability to do business?

As of April 29, 2020, PeerStreet continues to maintain its work-from-home policy to ensure the safety of both our employees and our community. Despite this, however, we use a variety of technological tools and have structured our operations in a manner that minimizes disruptions to our day-to-day activities. Notably, we have ensured that our customer support teams are available to address investors’ questions or concerns.

How are the moratoriums on evictions and foreclosures going to impact my portfolio?

Although many moratoriums on foreclosures and evictions focus primarily on owner-occupied loans and properties, non-owner occupied loans aren’t immune to current market conditions and moratoriums. In certain states, foreclosures are temporarily stayed and/or borrowers are permitted to defer payments. In others, foreclosure timelines are significantly delayed due to court closures and other similar issues causing backlogs. Accordingly, under current market conditions, the best option to protect interest and principal is often to defer interest payments and help stabilize affected loans.

Should I be worried about my portfolio health? Will these delinquencies and foreclosures impact my portfolio?

We expect delinquencies to rise and interest payments to be deferred. The overall impact on investor portfolios is yet to be determined. While maturities and foreclosure timelines may be extended, we have increased our asset management resources to increase responsiveness and manage downside scenarios, with the goal of protecting investors’ interests.

How do the current market conditions, or even a downturn/recession, affect PeerStreet’s business model?

PeerStreet was designed with the aim of withstanding varying market cycles. We built a two-sided marketplace that aims to balance the supply of loans with the demands of investing. While we cannot predict the future; however our business, systems, and platform have been designed to provide uninterrupted service and transparency during times like these.