Every US state has their own set of laws governing foreclosures. Some states require a lawsuit to be filed in court (judicial states), and the court oversees foreclosure proceedings. In non-judicial states, proof of default is enough to start foreclosure proceedings, which are handled outside of the courtroom.

As PeerStreet moves down the legal route of foreclosure, our Asset Management team will simultaneously attempt to negotiate a deal (“workout”) with the borrower as part of our effort to resolve a loan payment issue.

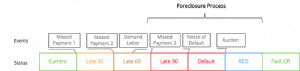

Foreclosure Timeline

1. Acceleration Letter Issued

Upon default, an acceleration letter is sent to the obligors accelerating or demanding the entire loan balance to be paid. While the Asset Management team continues its effort to cure any delinquency, the acceleration letter provides the borrower with official notice that the lender (or PeerStreet) intends to call a default on the loan, accelerate the debt, and foreclose on the property. The obligors have a certain time period to pay the loan in full. In judicial states, the next step is typically the filing of a foreclosure complaint in the local courthouse. In non-judicial states, the next step is typically the filing of an NOD or NOS (as defined below).

Non-Judicial

2a-i. Notice of Default Recorded

In some non-judicial foreclosure states, a Notice of Default (“NOD”) must be recorded to officially put the loan in default and start the clock on setting a foreclosure sale date. The NOD provides record notice that the loan is officially in foreclosure. Depending on state statutes, some states provide a redemption period for the obligor to pay the loan off to prevent foreclosure. For example, California law provides the obligor 90 days from the NOD date to redeem.

2a-ii. Notice of Sale Recorded

Though non-judicial state-specific rules vary, a NOD is normally followed by a Notice of Sale (“NOS”), whose purpose is to set the foreclosure sale date and provide notice of the sale date.

Judicial

(2b-i) Complaint Filed

In judicial foreclosure states, PeerStreet must navigate the court system to foreclose on a property. Once the notice period on the demand letter expires, a foreclosure complaint is filed, which initiates the lawsuit. Timelines for judicial foreclosures can be longer compared to non-judicial foreclosures depending on a variety of factors. For example, if the borrower does not file an Answer to the Foreclosure Complaint, then PeerStreet can move for default and default judgment and set a sale date. If the borrower retains counsel to defend itself in the foreclosure, however, the process may take longer as the parties may have to complete discovery (including depositions, interrogatories etc.), mediation, and trial. As judicial foreclosure actions are adjudicated in county courts, the speed at which these cases progress also depends on county court backlog and other county-specific considerations.

(2b-ii) Active Litigation

This status denotes the fact that the borrower is actively defending itself in the litigation. As judicial foreclosure actions may also include breach of contract actions against the borrower and/or guarantor, the defendant may also be defending against these contract claims in addition to the foreclosure. Many different events can take place during active litigation, making it difficult to pinpoint a specific time to resolution. Throughout this process, however, local counsel keeps moving the case forward and PeerStreet’s Asset Management team continues to oversee both in-court progress and potential out-of-court resolutions.

(2b-iii) Judgment Entered

Court-entered judgment in favor of PeerStreet is usually the final major milestone prior to holding a foreclosure sale in judicial foreclosure states. If the borrower never answers the complaint, this can happen relatively early in the process via a default judgment. If the borrower litigates, the timeline will vary based on the pleadings, court backlog, etc. In some jurisdictions, the sale date may be set at the judgment stage, while in others, the sale date may be set by the court in a separate hearing.

Foreclosure Sale or Foreclosure Auction

This status indicates that a foreclosure sale date has been set and is used in both judicial and non-judicial foreclosures. In most judicial jurisdictions the Sheriff conducts the sale, and in a few judicial jurisdictions a referee is appointed to conduct the sale. In most non-judicial jurisdictions, a Trustee conducts the sale. Once a sale date has been set, it may be moved to a different date for various reasons. For example, PeerStreet may begin a foreclosure and set a sale date. Once the date is set, the Borrower may enter a contract to sell the property but need additional time to close the sale and payoff the loan in full. In this scenario, PeerStreet may move the sale date to give the Borrower additional time to close the sale.

Behind the scenes, quite a bit of work is performed between the day that the sale is set and the day of the sale itself. This gap period is used to further assess the condition and value of the property, determine a credit bid by assessing the property value and amount of debt owed by the borrower, and interview brokers and property managers in case PeerStreet takes ownership of the property at the sale (“REO”), all the while continuing to pursue alternative resolutions. At the sale, if PeerStreet is the highest bidder, it will take title to the property as REO. If PeerStreet is outbid, it will receive net proceeds from the highest bidder.

REO

When PeerStreet takes over a property at a foreclosure sale, the property becomes known real estate owned or REO. After taking title to the REO property, if necessary, PeerStreet will secure the property, hire a broker and/or a property manager, perform repair or improvement work, and list the property for sale or rent. The main objective at this stage is to ultimately sell the REO while optimizing for both sale price and time on market.

Can happen at any time during (or before/after) the foreclosure:

- Bankruptcy

Borrowers, guarantors, and other parties claiming an interest in the underlying property may file for bankruptcy. When a party files for bankruptcy, an automatic stay of all collection efforts (including foreclosures) is instituted. While the automatic stay remains in place, PeerStreet cannot file for foreclosure, proceed with a pending foreclosure, hold a foreclosure sale, or otherwise engage in actions that can be characterized as an attempt to collect on the debt. When faced with bankruptcies, local counsel is retained to represent PeerStreet in the action and will generally file a proof of claim and attempt to obtain relief from stay in order to continue with the foreclosure. The timelines for bankruptcies can vary based on a number of factors, including which chapter bankruptcy was filed (usually Chapter 7, Chapter 11, or Chapter 13), whether the property is the debtor’s only asset, whether there are successive bankruptcy filings by interested parties, and/or whether the debtor can convince the bankruptcy court to confirm a proposed payment plan. Typically, lenders can expect to eventually obtain relief from stay and resume their foreclosure action.

- Title Claim

Despite brokers’, lenders’, and title companies’ diligence of a particular loan and property, issues may arise post-closing that call into question legal ownership of the property, lien priority or validity, etc. These risks are the reason why lenders obtain title insurance policies when they originate loans. In the event that title-related issues arise, lenders will file claims with their title insurer. It usually takes up to 30 days for title companies to review the claim and make a coverage determination. Where coverage is tendered, title companies will either pay off other claimants, tender payment under the policy to the lender, or litigate the issue against the other parties. Due to these fact-specific considerations, time to resolution cannot easily be forecasted, but PeerStreet’s Asset Management team continues to oversee both the claim resolution process and potential out-of-court resolutions. PeerStreet may also pursue a title claim while concurrently pursuing a foreclosure judgment.

Expiration of Foreclosure Redemption Period

In some states, the borrower has the right to redeem the property after the foreclosure sale by exercising their “Right of Redemption”. This right is created by state statute and varies widely in each jurisdiction. While some require the borrower to repay the full amount of the debt to “redeem” the property, others may only require the borrower to pay the foreclosure sale price. The amount of time until the right of redemption expires also varies by state.