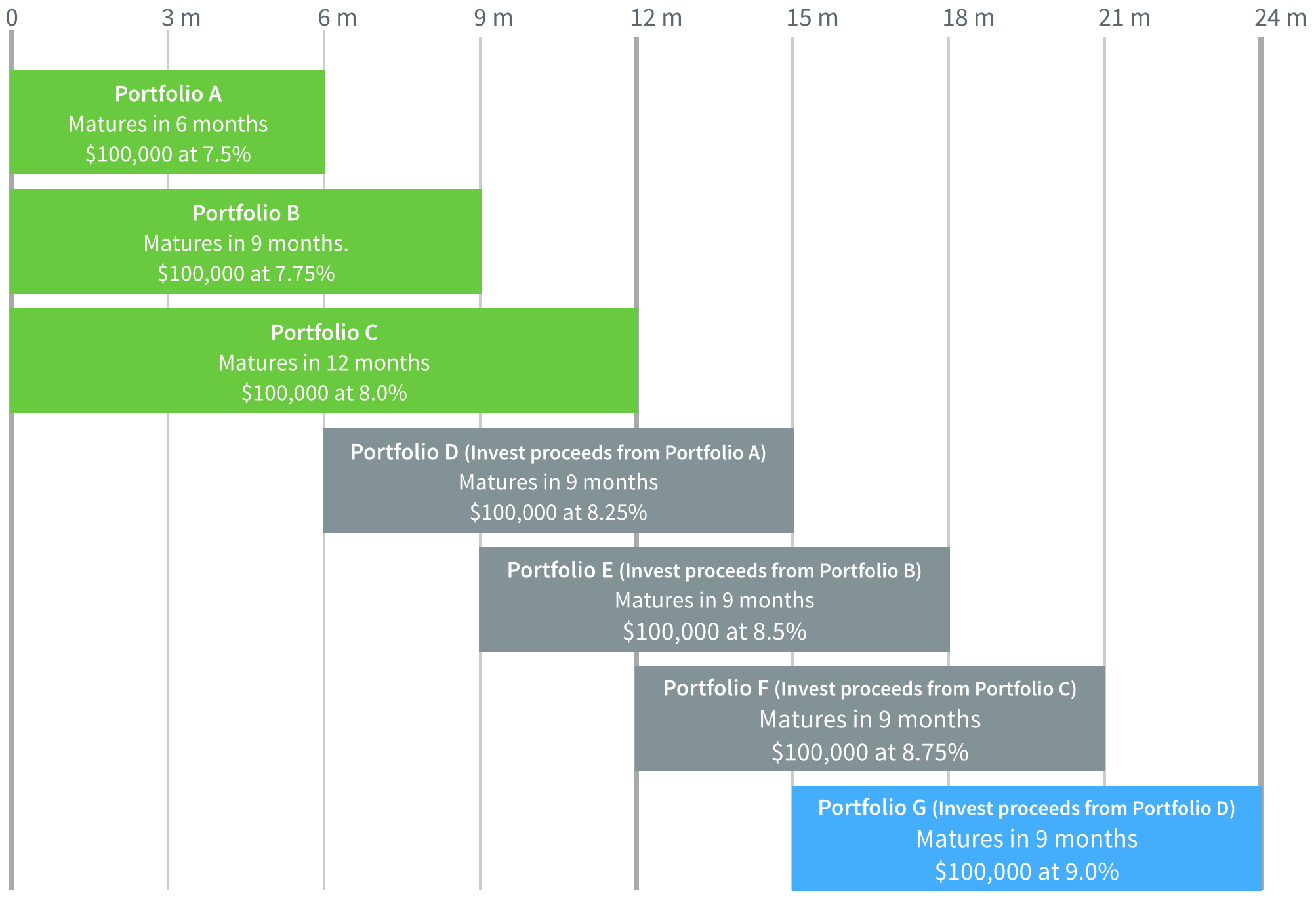

PeerStreet short-term loans (6-24 months) should not be as adversely impacted by a rise in interest rates as loans of longer duration. As interest rates rise, new loans also get originated at higher rates. Since PeerStreet’s loans have short terms, investors are able to recycle capital more efficiently and capture higher market rates much sooner. Some of our investors have constructed short-term “ladders” to invest in loans across the maturity/term spectrum, allowing them to (1) better capture market investment yields in a rising rate environment and (2) maintain a constant stream of liquidity. The image below depicts how you can construct such portfolios and increase liquidity in a rising interest rate environment, on a quarterly basis through laddering:

How will rising interest rates impact PeerStreet loans?

The information on this website does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information contained on this website is a recommendation to invest in any securities. By using this website, you accept our Terms of Service and Privacy Policy. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss. Full Disclosure.

© 2022 PeerStreet, Inc. All rights reserved.

PS Funding, Inc. CA Bureau of Real Estate - Real Estate Broker License No. 01984664; California Finance Lenders License 60DBO-45398

PS Funding, Inc. CA Bureau of Real Estate - Real Estate Broker License No. 01984664; California Finance Lenders License 60DBO-45398