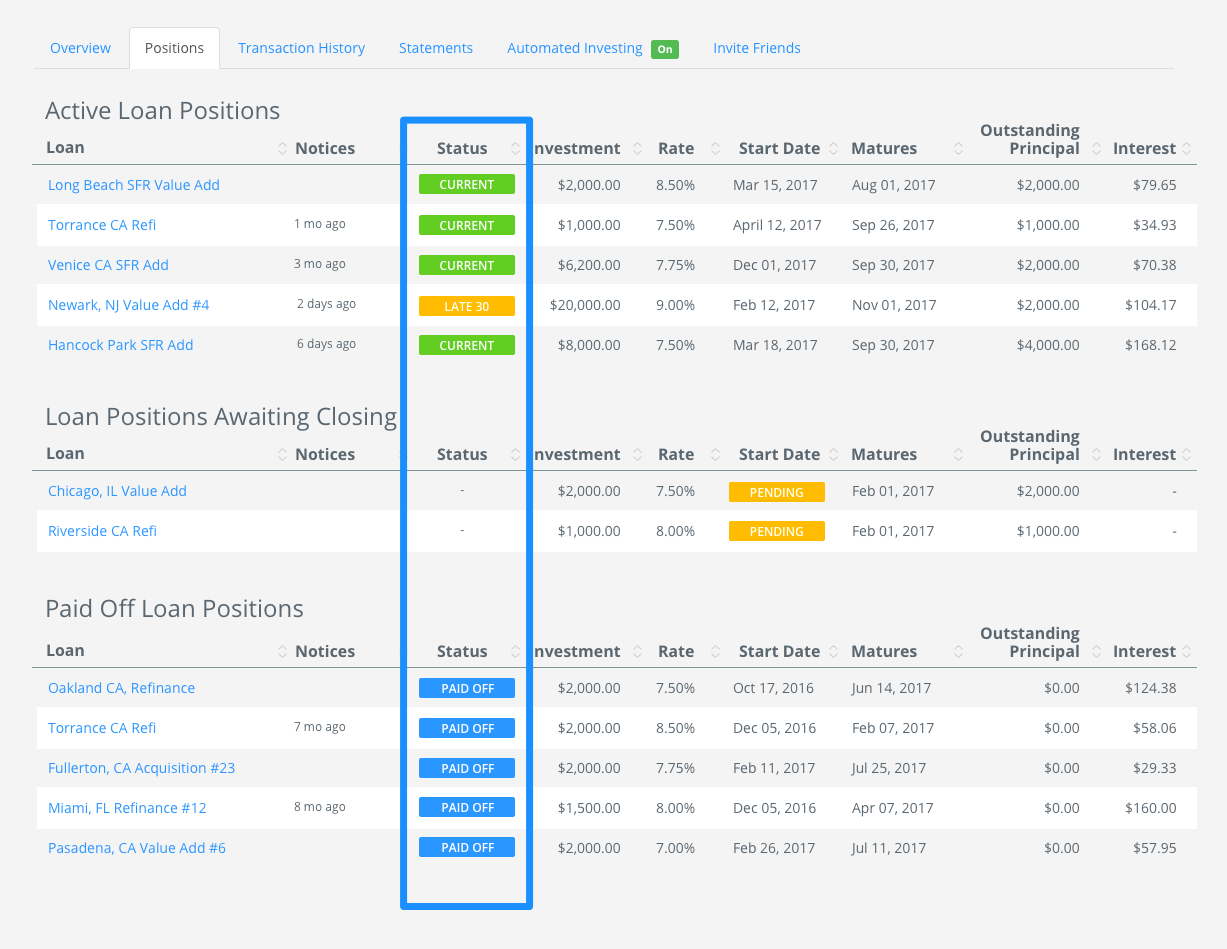

The Positions tab in your investor dashboard provides details about your investments, including distribution dates, investment-specific statuses, and necessary notifications for the loans in which you’ve invested. This enables you to monitor your entire portfolio at a glance.

The status may change throughout the life of each investment. To ensure the loan servicing process is transparent, this information is updated once per month—and sometimes more frequently.